India’s retail sector has been undergoing structural changes for the last two decades. Shopping malls, lined with specialty retailers, started dotting the retail markets of the country’s top cities during the mid-90s. Since then, the ‘mall culture’ gradually pervaded the population, especially in the metros and mini metros, heralding the beginning of the modern retail movement in India.

Presently, the modern retail penetration in India is abysmally low compared to the developed and emerging economies. While the share of modem retail is 84 per cent, 71 per cent and 53 per cent in the US, Singapore and Malaysia, it is only 19 per cent of the value of the total retail spending in the National Capital Region, Mumbai, Kolkata, Chennai, Bengaluru, Pune and Hyderabad cumulatively. In fact, the degree of penetration in the whole of India would be even lower since the presence of modem retail in smaller cities and rural areas is not significant.

Against this backdrop, this study discusses the various trends emerging in lndia’s retail sector, present market size and future potential of Mumbai Metropolitan Region (MMR), National Capital Region (NCR) and Bengaluru with special focus on fashion retail. The study has been limited to the aforementioned three locations as they account for 69 per cent of the total retail spending of the top seven cities taken together.

Defining modern retail has always been an ambiguous exercise, and, for the purpose of this study, all stores in a mall have been considered as modern retail constituents. In the case of retail stores on shopping streets, stores that provide a purchase invoice and have a basic structure and air conditioning have been considered as modern retail.

BENGALURU

Bengaluru has emerged as a sought-after retail market in recent years, with several foreign and national brands setting up their stores in the city. The city houses large-format retail malls, targeting both the luxury segment and value shoppers, while providing for modern retail space in shopping streets as well.

Fueled by the advent of the IT/ITeS sector, which witnessed the proliferation of a large number of people from other regions, Bengaluru is the third most populous city of India today, supporting a diverse demography.

During the last decade (2001–2011), the population growth was observed to have been significant, at a decadal growth rate of 33 per cent, which was substantially higher than the growth witnessed in the Mumbai Metropolitan Region (MMR).

With an estimated population of 10 million as of 2015, a sizeable 54 per cent of the city’s population comprises households earning above Rs 300,000 per annum, thereby translating into 5.2 million people that plays a major role in Bengaluru’s modern retail growth story

The Bengaluru retail market is characterised by a fair distribution of modern retail, largely impacted by rising consumer income levels. We have sized the city’s customer spending to get an understanding of the total consumption expenditure pattern.

A key observation in this regard is the city’s higher per capita consumption expenditure. With a growing population base, the total consumption expenditure in Bengaluru is on the heels of NCR and Mumbai, and stands at Rs 2,020 billion – a 16 per cent share of the top seven urban centres.

The present market size of modern retail in the city stands at Rs 154 billion, behind NCR and Mumbai, denoting the substantially low penetration of modern retail in the region (24 per cent), as compared to many cities in emerging economies. This low penetration of modern retail portends well for Bengaluru, as it holds immense potential to increase its share of modern retail in the forthcoming years. The potential of modern retail in Bengaluru stands at an estimated Rs 486 billion. While the city’s total modern retail expenditure stood behind Mumbai and NCR, its per capita modern retail expenditure surpassed these two cities considerably, by a margin of 115 per cent and 88 per cent, respectively. Its per capita retail expenditure stands at Rs 67,289.

Between 2015 and 2019, the modern retail market size in Bengaluru is expected to grow at a CAGR of 23 per cent, from Rs 154 billion in 2015 to more than Rs 363 billion in 2019. Further improvement in the macroeconomic parameters, a fast-growing cosmopolitan populace characterised by double incomes, high purchasing power and discerning tastes, and exposure to evolving trends are expected to enhance the share of Bengaluru’s modern retail.

We have estimated that by the year 2026, modern retail penetration in Bengaluru will increase to 50 per cent from the current 24 per cent, with both brick and mortar and e-tail formats contributing significantly to the growth. Total potential of modern retail in Bengaluru stands at an estimated Rs 486 billion.

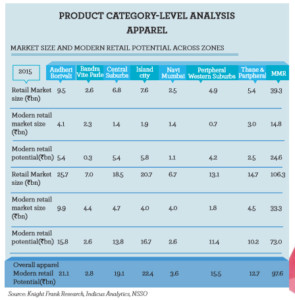

Bengaluru has a strong apparel market, dominated largely by traditional shopping streets, with the modern retail

potential in the overall, apparel category estimated at Rs 46 billion. The ratio of shopping streets is higher in the city, particularly in regions such as South and West Bengaluru. These regions, though substantiated with malls, have numerous shopping streets adjacent to heavily-populated residential areas. This denotes the lower modern retail market size in 2015.

The northern region, too, has a minimal modern retail presence, owing to its nascent retail markets and dependence on shopping streets. On the other hand, East Bengaluru, which has a number of large-format malls located in Whitefield, accounted for the highest modern retail market size in both, the ethnic and non-ethnic apparel categories. Owing to the current low modern retail presence, North, South and West Bengaluru have a high growth potential in the apparel category. Together, these zones have an annual potential of Rs 40 billion.

Modern Retail Space Scenario in Malls

Bengaluru has witnessed a relatively gradual and lower concentration of malls compared to NCR, and Mumbai. Mall development, which commenced in the central and off -central, locations of the city, has now spread to the peripheral locations as well. At present, Bengaluru has 26 malls, adding up to approximately 9.3 million sq.ft. of modern retail space.

North Bengaluru has the least occupied mall space per thousand of its population. This can be attributed to the fact that modern retail in this zone is largely nascent and comprises traditional retail, with modern retail penetration at 14 per cent of the Rs 93 billion total retail expenditure in the zone.

East Bengaluru remains the region with the highest amount of per capita occupied mall space per thousand of its population with a whopping 1,711 sq. ft. On the other hand, despite accounting for the largest quantum of mall space in the city, West Bengaluru has a lower per capita occupied mall space, at 430 sq. ft.

Mumbai Metropolitan Area

With a population base of 22 million, the MMR is one of the biggest urban agglomerations in India. During 2001-2011, the population increased at decadal growth rate of 24 per cent, which is a tad lower than the growth observed in top urban centres of the country. Nevertheless, Mumbai remains the financial capital of the country and is the hub for banking, financial services and insurance (BFSI) companies in India. The sheer size of the region in terms of population and its socio-economic profile make it one of the most important retail markets in the country. Nearly 57 per cent of the city’s population comprises households earning above Rs 300,000 per annum.

Mumbai is often projected as one of the most expensive cities in India. The MMR region has the highest consumption expenditure in the country, and stands at Rs 4,113 billion — a 32 per cent share of the top seven urban centres. In terms of volume, it is nearly double of Bengaluru’s consumption expenditure. The MMR also leads in terms of total retail expenditure.

At Rs 1,214 billion, the region contributes to nearly 29 per cent of the total retail expenditure in the top seven urban centres of the country. Such high retail expenditure is a big opportunity for retailers, and is one of the reasons why many international brands prefer to open their stores in the MMR. Despite having the highest retail expenditure, the Mumbai market lags behind NCR in terms of modem retail penetration. The MMR‘s modern retail market size stands at Rs 164 billion. Even today, Mumbai has a number of non-modern shopping streets. Quite a high volume of retail spending takes place in these traditional shopping areas. Likewise, the per capita modern retail spending in the MMR is far below that of Bengaluru and NCR.

The penetration of modem retail is extremely low in the MMR, primarily due to the haphazard and unorganised retail markets across the city. Some of the biggest shopping areas in the MMR, such as Crawford Market, Zaveri Bazaar, Hindmata Market, Lamington Road, Kalamboli Market, Linking Road, etc., are still non-modern, unlike NCR and Bengaluru, where shopping streets are transforming into modern retail destinations.

The present market size of modern retail in the MMR stands at Rs 164 billion, indicating a substantially low penetration of modern retail in the region (13.5 per cent), compared to many cities in emerging economies. At the same time, the retail expenditure of the MMR, at Rs 1,214 billion, showcases the region‘s potential for modern retail in the coming years. The potential of modern retail in the MMR stands at an estimated Rs 1,050 bn. Between 2015 and 2019, the modern retail market size in the MMR is expected to grow at a CAGR of 23 per cent, from Rs 64 billion in 2015 to more than Rs 381 billion in 2019.

We have estimated that by the year 2036, modern retail penetration in the MMR will increase to 50 per cent from the current 13.5 per cent with both brick and mortar and e-tail formats contributing significantly to the growth. The penetration of modern retail is the highest in the apparel product category across all the top three retail markets of the MMR, NCR and Bengaluru, primarily due to the presence of a number of national and international brands in this category. At the same time, most of the unorganised shopping streets in MMR have apparel and footwear as their major offering. Linking Road, Colaba Causeway and Hindmata Market in Dadar are some of the shopping streets that predominantly sell apparel, footwear and accessories.

The annual modern retail potential in the overall apparel category is estimated to be Rs 98 billion. The island city zone has the highest potential for the apparel category, mainly due to the limited number of malls and modern shopping streets in MMR. Despite a strong customer base, the zone lacks modern retail supply. High real estate cost in the zone is also one of the reasons for the limited modern retail development. On the other hand, despite haying a number of malls, the Andheri—Borivali zone has a huge annual potential of Rs 21.2 billion for modern retail in the apparel category. The modern retail potential is higher in the non-ethnic category across all zones in the MMR.

Modern Retail Space Scenario in Malls

As of December 2015, the MMR had 33 operational malls. While the MMR ranks second in the country in terms of total mall space, it lags when compared to population density. The occupied mall space in the MMR per thousand of its population stands at 350 sq. ft. A comparison of the zones within the MMR indicates that at 723 sq. ft., Navi Mumbai has the highest mall space density. The Bandra-Vile Perle zone has no malls. Consumers in this zone are either dependent on shopping streets looatecl within the zone or malls in other zones Andheri – Borivali and the Central suburbs have a relatively higher per capita mall space per thousand of their population compared to overall MMR. The availability of large land parcels at decent prices has facilitated mall development in the region. The retail expenditure in these zones is also quite high, which contributes to the feasibility of malls in these locations.

NCR

The NCR is one of the major retail hubs in the country. The market’s prominence emerges from its diversity in demography and lifestyle, which has had a huge impact on shaping its retail business. It’s growth was fueled majorly by the growth in the service industry, which opened up vast job opportunities in the region, leading to huge immigration from its neighbouring states. Among the top three cities, the NCR has experienced the highest decadal growth of 47 per cent between 2001 and 2011, and is estimated to have a population of 24 million as of 2015. A substantial 48 per cent of the city’s population comprises households earning above Rs 3,00,000 per annum. An estimated 11.4 million people have made the maximum contribution to NCR’s modern retail market.

Propelled by surging household incomes and other socio-economic factors, consumer spending is increasing at a faster pace. Despite a larger population base, the total consumption expenditure in NCR is less than Mumbai and stands at Rs 3,494 billion — a 31 per cent share of the top seven urban centres NCR is a close second to Mumbai in the total retail expenditure as well. Together, both cities account for more than 59 per cent of the retail consumption pie of the top seven cities. However, the NCR surpasses Mumbai and Bengaluru in the total modern retail expenditure. Of the total Rs 801 billion modern retail expenditure of the top seven cities, an approximate 34 per cent share is taken up by the NCR. It’s modern retail market size stands at Rs 269 billion. The NCR’s per capita modern retail expenditure is substantially lower than Bengaluru.

Approximately 59 per cent of the modern retail stores in NCR are on shopping streets and the rest, in malls. However, due to restricted store sizes, the space occupied by modern retail stores in malls is much more, taking up 57 per cent of NCR’s total modern retail space. The total consumption expenditure (which includes rent, transportation, utilities, education, medical and insurance) in NCR stands at Rs 3,494 billion, of which Rs 1,047 billion comprises the total retail expenditure The present market size of modern retail stands at Rs 269 billion. Since the penetration of modern retail in the NCR is substantially low (26 per cent) as compared to many cities in emerging economies, it has a huge potential to increase its share of modern retail in the total retail market of the city. The potential of modern retail in the NCR stands at Rs 779 billion.

Between 2015 and 2019, the modern retail market size in NCR is expected to grow at a CAGR of 24 per cent, from Rs 269 billion in 2015 to more than Rs 630 billion in 2019. The growth in the macroeconomic parameters, a fast growing middle class with increasing disposable income and a population that is steadily moving into the peripheral markets of Gurgaon, Noida, Ghaziabad and Faridabad are expected to enhance the share of NCR’s modern retail. We have estimated that by the year 2028, modern retail penetration in the NCR will increase to 50 per cent from the current 26 per cent with both brick and mortar and e-retail formats contributing significantly to the growth.

The annual modern retail potential in the overall apparel category is estimated to be Rs 19 billion. The service industry and growth in income have attracted brands and retailers that have set up modern stores in the region, which explains the high penetration of modern retail in this product category. In addition to its own population base, Central Delhi, which mainly comprises Connaught Place, Janpath, Chandni Chowk and Karol Bagh, caters to consumers from NCR’s other zones in terms of apparel purchase. Similarly, due to their strong consumer base, South Delhi, Gurgaon and Noida have some of the best malls and stores in the entire NCR, which not only attract their own catchment but also benefit from expenditure from other zones.

On the other hand, there is a high growth potential for the apparel category in North and East Delhi. Together, these zones have an annual potential of Rs 32 billion. In general, the modern retail potential is higher in the non-ethnic category than the ethnic category.

Modern Retail Space Scenario in Malls

North Delhi has the least occupied mall space per thousand of its population. This can be attributed to the fact that retail in this zone largely comprises traditional retail, with modern retail penetration only at 7 per cent of the Rs 228 billion total retail expenditure in the zone.

ln Greater Noida, the per capita mall space per thousand of the population is also quite low. This can be explained by the fact that total modern retail expenditure in Greater Noida is very limited. From the Rs 8 billion total retail expenditure, only 1 billion goes towards modern retail. Malls in Faridabad are concentrated on Mathura Road, and its occupied mall space is concentrated mainly in three malls. The ongoing construction on Mathura Road and the metro work has adversely affected retail in this zone Gurgaon and Noida have the highest per capita mall space per thousand of their population. Unlike other zones, Gurgaon and Noida are characterised by the availability of large land parcels that facilitate large-format malls. The Great India Place and DLF Mall of India in Noida, and Ambience Mall in Gurgaon are examples of large-size malls in NCR.

Conclusion

The Indian retail market witnessed an enormous change in the last few years. Evolving consumer spending patterns and increasing disposable income levels are redefining the country’s retail landscape. There is ample dynamism at present. With a number of international brands entering the market. The existing brands are also working towards reinventing ways to keep up with the pace of growth in the sector. Currently. the total retail spending in the top seven retail markets of the country amounts to Rs 4,172 billion ($62 billion) and this is projected to reach Rs 8,762 billion ($132 billion) by 2020. Going forward, a substantial portion of this retail spending will continue to take place in the non-modern retail segment as well. The penetration of modern retail will also witness a substantial rise from the current 19 per cent to 24 per cent in the next five years in the top seven retail markets.

The mall culture has pervaded India, especially in the metro, heralding the beginning of the modern retail movement

Must Read